They all believed the plots were legitimate.

After getting transfers from the Mavoko Town Council as well as approvals from the lands office in Machakos and permanent buildings come up, Arthur Omollo, like thousands of other eager home-seekers, knew all was well with Syokimau plots that they had just bought.

Samuel Isiaho and Ben Avaga did a title search at Ardhi House, the headquarters of the Ministry of Lands and Settlements, before buying their parcels from the 950-member Jumbo Housing Scheme. They were made to believe that the allocations were clear.

Everything at Syokimau estate appeared to be in order — until the monster-like demolition machines began tearing down multi-million-shilling residences last November. Mr Omollo and 600 others discovered too late that they had built houses on land belonging to the Kenya Airports Authority (KAA).

The Syokimau allocations were a grand con scheme. Public officials insinuated themselves between dishonest land agents and land buyers, many of whom were unsuspecting, with the aim of enriching themselves. The officials may have been privy to the scheme and therefore colluded in the shady deals.

For four months, this writer has attempted to gauge the involvement of state officials and institutions in one of the country’s biggest land scandals in which 3,000 people bought land earmarked for the expansion of Jomo Kenyatta International Airport (JKIA).

Investigations have uncovered organized forgery and complicity of state employees. The fraud was easy to execute. One, the vast land was unsecured.

Two, state officials were ready to create phantom files and respond to public searches. Three, the government lacked a system for information-sharing so the right hand didn’t know what the left was doing. Four, KAA did not have a register for its assets.

How the scam was executed

At the centre of the questionable deal were three land-buying companies: Uungani Settlement Scheme self-help group, Jumbo Community Self-Help Group, and Mulolongo Brothers Association (Company). Together, the groups “owned” 1,200 hectares contiguous, adjacent to JKIA.

They hived off LR no. 13512 (Uungani), LR no. 143231 (Mulolongo), and LR no. 143231/2 (Jumbo) off LR no. 21919 (4459.1ha) belonging to KAA.

The three claim to have been allocated the parcels variously between 1988 and 1998. However, if available documents are anything to go by, the groups may not have been legal entities when they acquired Syokimau. The Ministry of Sports, Culture and Social Services registered Uungani in 2008, while Mulolongo was registered on June 8, 2008.

Why the three land merchants waited until 2003 to start subdividing the land they had acquired 15 years earlier – or putting up houses – has raised questions.

What has emerged is that the large parcel was allocated to them by State officials who knew that KAA was the real owner of the land in question. Ardhi House then sanctioned the deals. The process wasn’t regular, but the resultant documents are hardly forgeries. “It is a case of double allocations,” a senior official at Ardhi House, who requested anonymity, said.

In fact, the Director of Surveys at the Ministry of Lands once questioned the transaction. “It is significant to note that the Commissioner of Lands gave a letter allotment, and a new grant survey was performed that caused the new parcel to be born, i.e. LR no 14231/1 (claimed by Mulolongo Brothers),” B.K Gitonga, an official in the Nairobi Provincial Office, wrote to the Deputy Registrar of the High Court, W.M Muiruri, on November 3, 2009.

Mr. Joseph Kabilu, the secretary of Jumbo, says the then Commissioner of Lands, James R. Njenga gave his group the letter of a llotment for LR no. 14231/2, a 200-hectare piece next to Uungani, in 1986. (Mr. Kabilu says he is under instructions from the CID not to disclose any documents.)

As for the 1,800 member Uungani Scheme, it is the Commissioner of Lands official Wilson Gachanjah who issued them a letter of allotment for LR no. 14231 on September 15, 1996, within weeks. This ‘allotment’ was certified by the Registrar of Lands, despite the fact that KAA had already acquired the title the previous month.

A letter of allotment is a formal offer by the Commissioner of Lands to enable an applicant to purchase land; it does not in itself prove ownership.

And before Jumbo, there was the 1,600 member Mulolongo Brothers Limited, whose directors are Stephen Nzuki Mwania, Muteti Musombe, John Mutuku Muinde, James Njoroge Murigi, Solomon Mwinzi Mwau and Vijaykumar Kantilal. The government sats Mulolongo fraudulently acquired 100 hectares registered as LR no. 13512.

Involvement of public officials

Investigations indicate that the land buting companies took advantage of loopholes in Kenya’s land transfer process to perpetrate a scandal. Working with Ministry of Lands officials and the Attorney General’s Chambers, they ensured that potential land buyers would not suspect a thing.

The involvement of Ardhi House was crucial to lend credibility to the transactions and to make it easy for the ministry to give potential land buyers the greenlight. Uungani even managed to have a land transfer file created at Ardhi House.

In this way, Uungani – whose listed directors are Wambua Mila, Elijah Runo and Charles Agutu – could now pay statutory fees. On April 12, 2002, Uungani paid Sh 1,123,124 as a legal conveyance fee and Sh 120,090 for stamp duty, rent and survey through cheque (no. 014384 and no. 0148110) and was given receipt no. F256373. This couldn’t have happened without the knowledge of lands officials.

With the requisite file established at Ardhi House, potential property developers could not doubt the availability of Syokimau land. “Uungani Settlement Scheme may have been in collusion with the Ministry of Kands officials to prepare, authenticate and grab public land,” says a report by the Parliamentary Committee on the Syokimau allocations.

Unlike Uungani, Mulolongo Brothers used a different route to seek “legitimacy”. It decided to relocate the transaction documents from Nairobi to Machakos by converting their parcel from Registered Title Act (RTA) to Registered Land Act (RLA) through a legal notice.

“To avoid deeper scrutiny, somebody thought it wise to move files from Ardhi House to the Machakos Lands office,” a source at Ardhi House said.

All transactions under the RLA are done in the respective Districts while those that fall within the jurisdiction of RTA are done in Nairobi and/ Mombasa. There is a disagreement over the location of Syokimau, although section 5 of the Local Government Act (Chapter 256) gives Machakos control over Syokimau.

Judging from correspondence, it would appear that some elements in the government were asked to fast-track the request. In one such attempt, the Chief Land Registrar’s office certified Mulolongo’s application for conversion, filed by J.R.R Aganyo, a licensed land surveyor based at Old Mutual Building, Kimathi Street, Nairobi. The letter was referenced ARA/23/1X/58.

Upon receiving the letter and certifying it as CLR/R/47/A on May 5, 2009 in the Land Registry, A.W Kuria, wrote to the director of Surveys Ephantus Murage to seek the viability of the conversion in terms of the law. Somehow, the same office of Director of Surveys that had surveyed the plot for KAA way back, confirmed that the conversion was indeed viable.

“This is to confirm that it will be possible to produce a Registry Index Map (RIM) for (LR no. 135120) upon your conversion of the same,” H.F Jumba, an official in the Director of Surveys office, wrote to the Chief Land Registrar on June 16, 2009. Jumba copied the letter to J.R.R Aganyo & Associates, the Mulolongo Company surveyor.

Mr Kuria had purportedly written to the Attorney General Amos Wako three weeks earlier, appearing to lobby for the conversion. “The conversion is meant to facilitate the issuance of the title under (RLA). Please approve and return for signature by the Minister before publication in Kenya Gazette,” he stated.

Mrs E.N Gicheha, the Deputy Chief Land Registrar, tried in vain to stop the process on claims that it was irregular because a copy of the title had not been authenticated. She wrote to J.R.R Aganyo: “I note that the copy of the title you forwarded is not registered and request, for a certified copy of the same to enable me proceed.”

Somehow, and inexplicably, the Gazette notice (no 157 of 2010) was eventually published on August 26, 2010. Ardhi House claims somebody forged the signature of Lands Minister James Orengo as well as that of Ms Gicheha to facilitate the publication, according to our contact at Ardhi House.

J.R. Aganyo now distances himself from the deal. “They (Mulolongo Brothers) had asked us to do some work for them, but when we inquired about the survey plan, approvals from Commissioner of Lands and the search documents to ascertain the authenticity of the transactions, they just disappeared,” Mr Aganyo said. “We asked for all these things, but they didn’t give us anything. We didn’t work for them.”

When contacted, Mr James Njoroge Murigi, a director of Mulolongo, said: “What else do you want to know? You people (of the Press) have written everything you want. The matter is before Parliament. It is not the people to judge; it is the courts.” Then he hung up.

Nonetheless, with the files safely in Machakos, it was easy for the buyers to acquire the requisite part developments plans (PDP) from Mavoko Municipal Council. Machakos lands office personnel and a government surveyor strategically placed themselves to respond to any search queries about the Mulolongo land. They judiciously justified the availability of the land for potential buyers who made searches at the Machakos Lands office.

PDPs are used for land allocations. They are prepared by the Director of Planning and show the exact site of any development on a parcel of land – whether for residential, agricultural, industrial or business use.

“Officials at the Machakos Lands office confirmed the title (belonged to Mulolongo) on April 25, 2006,” according to Mr Tubman Otieno, who was Mavoko Town clerk at the time. “We thus had no reason to doubt.”

Why Syokimau was a target

The fact that the commissioner issued allotment letters for land already earmarked for the public good is striking. In law, alienated government land can only be placed in private hands through an elaborate process involving the public.

Now, the million-dollar question is: Why was it so easy to give out State land? Or better still, why was state land an easy target?

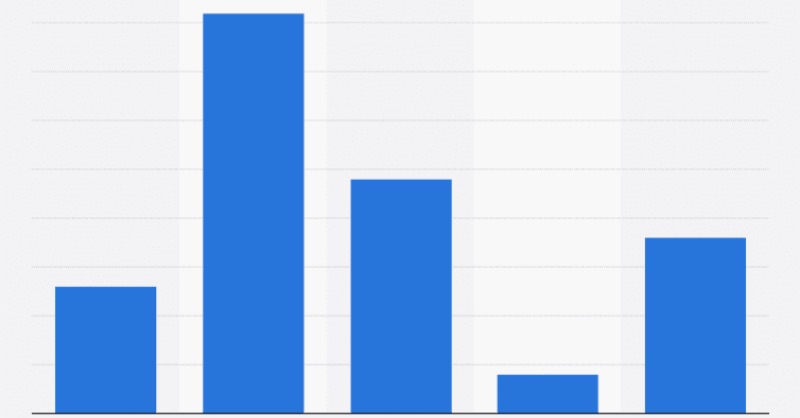

Land fraudsters know that the government does not have an information-sharing mechanism among its various offices and bodies. Thus, one could undertake “double allocations” without raising eyebrows. And in the case of land management, Ardhi House has been the stumbling block in attempts to establish the Kenya National Spatial Data Infrastructure, which would facilitate information-sharing among institutions.

Secondly, State employees often take advantage of confusion to target public land. And, naturally, by virtue of their positions in government, they will be equipped with information about land that can be grabbed without kicking up a storm. Syokimau was vast, uninhabited and had no developments to prove it belonged to anyone. In fact, KAA had leased it to livestock ranches, including Pokeny Ranch of Kajiado, in what it called “temporary occupation”.

KAA inherited the land from the defunct Kenya Aerodromes Department on June 7, 1994, through Kenya Gazette legal notice no. 201. Earlier, through other notices, 439 and 440, of February 25, 1982, the department acquired Syokimau Farm Ltd (L.R 7149/11/R), with an eye on expanding Jomo Kenyatta International Airport.

KAA, despite contributing about 10 per cent to the country’s Sh2 trillion GDP (about Sh200 billion), failed to fence off its land. What’s more, it did not have a register of its fixed assets. &nbs

p; So, implicitly, KAA hardly knew the size of land it owned. “Under the circumstances, I have been unable to confirm that the fixed assets are fairly stated in the accounts,” the parliamentary Public Investments Committee (PIC) committee chair, Prof Anyang’ Nyong’o, stated in 1995.

As if that was not enough, KAA’s asset management was suspect. For five years from 2001, the authority maintained two titles for the same land. LR no. 24937 (4,674.6 ha, registered in 1996) was not surrendered when KAA acquired a new one, Title LR no. 21919 (4459.1 ha) following the excision of JKIA from Mombasa Highway.

In fact, scrupulous officials at Ardhi House had cautioned KAA about the irregular transactions. G.L. Mukofu, an official in the office of Commissioner of Lands, wrote to John Tito, the KAA chief legal officer, in December 2005, saying: “Please note that all the purported allocations as depicted in Letters of Allotment to M/S Uungani Settlement Self-Help group and Mulolongo Brothers Association are not genuine”.

Were the KAA actions deliberate? The KAA management declined to be interviewed for this story and did not respond to questions sent to it two months ago. “Failing to maintain a fixed assets registrar is deliberate, so that land is available. You can shop small pieces on the edges,” said lawyer Paul Ndung’u, the chair of the 2003 Commission of Inquiry into the Illegal/Irregular Allocation of Public Land whose damning report was presented to President Mwai Kibaki in June 2004.

Instructively, the land deals happened during the tenure of Mr Peter Kipyegon Lagat as CEO, who is facing a court case over abuse of office in which business people colluded to acquire land belonging to the Moi International Airport. He is charged jointly with Wilson Gachanjah, the Commissioner of Lands at the time. It was during Lagat’s tenure that KAA was scandal-ridden, including a fraudulent scheme in which Anglo Leasing suspect Merlin Kettering failed to fully implement a $760,000 computerisation programme despite receiving the payment.

“(The government) should be held responsible,” said the Mutava Committee. “The Lands registry, Ministry of Lands, Machakos, provided certified copies of land documents and in collaboration with the Mavoko Municipal Council approved land allocation and development plans.”

Lawyer Ndungu adds, “Corporations would write to the commissioner of lands and say they didn’t think they needed ‘all this land’. By the time the letter was done, they would have made arrangements with the commissioner to fast-track the issuance of documents (such as letter of allotment). There would be people already on the land, waiting to transfer the same to other individuals or corporations.”

From the interviews, KAA only moved against the encroachers following the terrorist attack on an Israeli airline at Moi International Airport, Mombasa. The International Civil Aviation Organisation had threatened to declare JKIA unsafe, subsequent to the incident.

“Following the attempt on the airline, many airlines … pulled out of JKIA with attendant (revenue) losses. One of the reasons cited for pulling out was lack of sufficient security measures at the JKIA,” says a brief prepared by KAA lawyers.

Consequently, the World Bank gave Kenya $11.5 million loan to develop a perimeter wall around JKIA and to assist in constructing the second terminal, which is almost complete. The tender for the construction of the wall (contract KAA/ES/JKIA/658/CON) went to Nyoro Construction Company for Sh100 million, but the company could not proceed after Uungani went to court claiming that KAA was encroaching on its land. The project is still stalled.

The World Bank cautioned that if construction of the perimeter wall was delayed, it would cancel the loan. JKIA was first used in 1958, then known as Nairobi Airport. It was designed to handle 2.5 million passengers a year; today it handles more than 7.5 million.

Syokimau is a classic example of how thousands of Kenyans fell prey to fraudsters working jointly with corrupt public servants. Mr Ndung’u says “in excess of 300,000” titles countrywide are illegal. And that, he adds, is a conservative figure.

“It is a case of people entrusted with safeguarding public property robbing the public,” said Jotham Okome Arwa, a lawyer and expert in land matters.

“I can only guess that it was the work of smart conmen,” said Mr Ndung’u. “Normally (fraudsters) don’t act alone. They incorporate various public officials. It is often a cartel.” His 2004 report warned about possible transactions like Syokimau. The recommendations of the commission of inquiry that he chaired have yet to be properly implemented.

— This piece has been published with the support of Africa Centre for Open Governance (AfriCOG) through its Investigative Journalism Programme. The views expressed in this article are not necessarily endorsed by AfriCOG.

Link to the story in The Nairobi Monthly Law website

At the centre of the questionable deal were three land-buying companies: Uungani Settlement Scheme self-help group, Jumbo Community Self-Help Group, and Mulolongo Brothers Association (Company). Together, the groups “owned” 1,200 hectares contiguous, adjacent to JKIA.